12 essential self-care tips during separation or divorce

A family lawyer bravely reflects on her own experience of divorce and explains the essential self-care tips that she picked up along the way.

We make the difference. Talk to us: 0333 004 4488 | hello@brabners.com

If you’re going through a divorce, we’re on your side. Our award-winning solicitors will help you to achieve financial security and a fair settlement.

While most divorces are straightforward, some can be more complex. Whatever your situation, our specialist solicitors will listen with empathy, represent your best interests and help you to achieve financial security.

You’ll have the country’s leading divorce experts on your side. Our award-winning family law team is ranked in Band 1 by Chambers and Partners, as a Leading Firm in The Legal 500 and featured in The Times Best Law Firms, with individual team members routinely recognised for excellence.

We’ll guide you through the divorce or civil partnership dissolution process in the smoothest and least acrimonious way possible, helping you to achieve the best possible outcome.

Whether your divorce is disputed or amicable, taking strategic advice can make a huge difference. We can advise on the financial implications of when and where to start divorce proceedings, along with the consequences of getting your final divorce order before financial claims are resolved.

We have welcoming offices across Liverpool, Manchester, Leeds, Lancashire and London, though we can assist you wherever you’re located across England and Wales including if you’re based internationally.

Talk to our divorce and financial settlement solicitors today by calling 0333 004 4488, emailing family@brabners.com or completing our contact form.

Our extensive divorce team contains some of the legal industry’s best-regarded experts, including lawyers "at the very top of the profession" who are renowned for securing exceptional outcomes for clients in difficult circumstances.

We have particular expertise in high-value divorce cases and those involving complex asset structures. We advise on all issues relating to financial claims, such as the extent of family assets and the timing and strategy of financial claims. We can assess settlement parameters at an early stage, including lump-sum payments, property transfers/sales and pension shares.

The team is highly experienced in cases that involve spousal and children maintenance issues where the main source of family income is derived from dividends or fluctuating bonus payments.

Your divorce may have an international complexion. We’ll help you to navigate the important choices, such as the most appropriate jurisdiction to issue divorce or dissolution proceedings. We also advise on ex-pat and foreign or religious marriage issues, including financial orders, mirror agreements and offshore assets.

We offer the full range of dispute resolution options, including arbitration, collaborative law and support through mediation and litigation. When required, we’re tenacious in obtaining the best possible outcome for your future.

“Getting divorced was the hardest thing I've ever done. I had taken advice from other firms over the years but... felt there was no empathy. I just wanted someone who was understanding, supportive and (most importantly) honest. From the first meeting, Richard Rigg demonstrated professional integrity, honesty and support... and made me feel like I could ask anything and not be judged. I believe that I got the best possible outcome for me and my child both financially and emotionally.”

Client feedback

“I just wanted to thank you [Joe Ailion] again for your help and support in my divorce settlement. I admire and respect your dedication and professionalism, but mostly I want to acknowledge your compassion and kindness throughout. As time passes, I will think of you as a friend who guided and gave me a voice through my troubles and took me on journey to a brighter place.”

Client feedback

“To have a team of people who can hold space for those going through what might be the toughest time of their life is essential. Cara [Nuttall] is the best at navigating this difficult time by walking side by side through the legal process of divorce with expertise and compassion.”

Occupational Wellness Practitioner

“After a ten-year ordeal — spanning separation, divorce, child custody and financial disputes... The outcome is everything I'd hoped and prayed for — not just for me but for my girls, my future and the chance to finally move forward... [I prayed] for God to hand-pick not just any legal counsel but His very best for my case. And He chose YOU.”

Client feedback

“I’m so grateful to Brabners — particularly Danielle Hutchinson and Caitlyn Oaten — for their outstanding support during a long and complex financial case. From the FDR hearing right through to the final settlement and property transfer, they carried out everything with professionalism, empathy, and precision. I couldn’t have asked for better legal representation.”

Client feedback

“Brabners has one of the North of England’s largest family law teams, with expertise across financial, children, international and fertility work.”

The Times Best Law Firms 2025

A family lawyer bravely reflects on her own experience of divorce and explains the essential self-care tips that she picked up along the way.

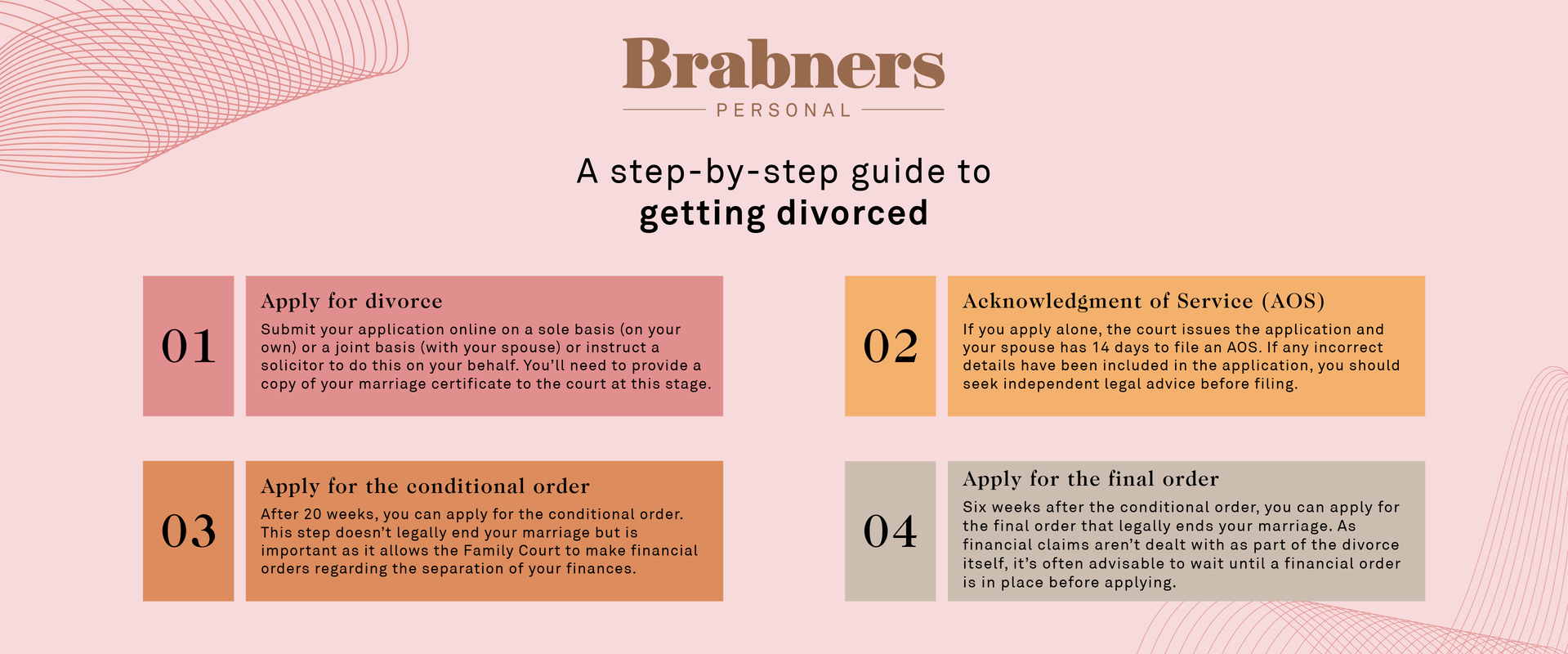

Divorce isn't an option until after 12 months — but alternatives like annulment, judicial separation and separation agreements are available.

When making a financial order, the court will have to consider all types of assets owned by the parties (whether in their sole name or joint names) including capital, pensions and income. The court has wide power and discretion when it comes to distributing those assets.

It’s a common misconception that when spouses separate any inheritance received by either party will automatically be excluded from any divorce settlement. The court is required to consider the factors listed in Section 25 of the Matrimonial Causes Act 1973, which include “the financial resources the parties have, or are likely to have, now or in the foreseeable future”. On that basis, the court will consider all assets belonging to the parties (irrespective of the source of those assets).

This can be a complex area of law and it’s recommended that you take specialist advice. Our team has significant experience with pensions and inheritance on divorce to ensure that your assets are handled correctly.

How can individuals protect inherited assets in the event of a relationship breakdown?

We explore how pensions are treated in divorce, from entitlement and valuation to division options.

When a couple divorces or dissolves their civil partnership, they will usually be able to reach a financial settlement by mutual agreement. Yet this isn't always possible — and in such cases, financial remedy proceedings are often instigated to seek the court’s assistance in determining a ‘fair’ financial settlement.

The court will use Section 25 of the Matrimonial Causes Act 1973 to decide on a ‘fair’ financial settlement. The primary consideration will be the welfare of any children, though other factors include the earning capacities, financial resources, ages and the conduct of parties to the divorce.

As skilled litigators, we'll defend your best interests if any challenges arise during the divorce proceedings.

Our family law team helped a young entrepreneur to reach a suitable financial settlement in highly contested court proceedings following his divorce.

We explore how adultery and other forms of misconduct fit into the current divorce framework and when behaviour affects the financial settlement.

The court has the power to make a variety of financial orders upon divorce or dissolution of a civil partnership. This is usually embodied in a legally binding court order, known as a financial consent order. Types of financial orders include:

Our divorce law team has specialist knowledge of financial orders and will guide you through the process.

Are you married to a narcissist? If your partner lacks empathy, they may be extremely challenging to divorce — especially when children are involved. Here, our Partner and family law expert Debbie Heald offers eight practical tips for anyone struggling to divorce a narcissist.

We explore how adultery and other forms of misconduct fit into the current divorce framework and when behaviour affects the financial settlement.

Read more

We explore how the courts approach trusts on divorce and outline the key considerations for dealing with them after separation.

Read more

We explore the process of valuing a business and reaching a financial settlement upon divorce or dissolution.

Read more

We explore how the courts approach parental contributions in divorce and the practical steps families may need to consider.

Read more

We explore how pensions are treated in divorce, from entitlement and valuation to division options.

Read more

We set out everything you need to know about financial orders — how they work, the different types and more.

Read more

The importance of a Pension Sharing Order, the process for implementing one and the remedies available if one party fails to engage in that process.

Read more

NDAs are becoming more prevalent in divorce proceedings, especially for high-profile individuals or where sensitive information is concerned — but do you need one?

Read more

International divorce cases are highly complex and the choice of jurisdiction can make a significant difference to financial outcomes.

Read more

January and September are the most ‘popular’ months to begin divorce proceedings — we look at why and top tips for couples thinking of separation.

Read more

Divorce isn't an option until after 12 months — but alternatives like annulment, judicial separation and separation agreements are available.

Read more

The Supreme Court has clarified the law surrounding when ‘non-matrimonial property’ can become ‘matrimonial property’.

Read more

Here, Amy Harris from our family law team and Rachel Brassey from our corporate team explain exactly what information a business owner may be expected to share during a divorce.

Read more

In the realm of financial remedy proceedings following divorce, the duty of full and frank financial disclosure is a long-established principle.

Read more

Three common divorce pitfalls involve clean break orders, pension rights and Will writing. Find out the importance of obtaining a financial order.

Read more

Here, Chris Fairhurst explores Mr Vince’s experience of the financial settlement process and outlines the importance of considering nuptial agreements.

Read more

Following the festive period — and in the optimism of a new year ahead — many couples find themselves taking a hard and truthful look at their relationship.

Read more

The computer system glitch failed to detect that divorce applications were submitted too early, meaning that these divorces may not be legally valid.

Read more

Divorce law expert Amy Harris explains when and why financial information needs to be disclosed during a divorce and the risks that come with non-disclosure.

Read more

A family lawyer bravely reflects on her own experience of divorce and explains the essential self-care tips that she picked up along the way.

Read more

Our family law team helped a young entrepreneur to reach a suitable financial settlement in highly contested court proceedings following his divorce.

Read more

Our family law experts secured a property transfer for a client who divorced abroad and wasn’t granted a financial settlement as part of her divorce.

Read more

Find answers to our most frequently asked questions about divorce law from our expert family solicitors.

Read more

Family law expert Debbie Heald offers eight practical tips for anyone struggling to divorce a narcissist.

Read more

Here, we explain why separating spouses should always obtain a financial order following divorce.

Read more

Our independence allows us to be objective, principled and provide a service with heart and character.

We’re on a mission to make the difference for our clients, people and communities. Proudly anchored in the North since 1815, we serve all of England and Wales.

Northern Ambition

The collaborative network for purpose-led businesses. We’re building a more sustainable and innovative tomorrow.

Sustainable Business

In 2022, we proudly became the UK’s largest law firm (and the first outside London) to become B Corp certified.

Community Impact

We channel the energy of our public-spirited people and clients towards improving our local communities.

Loading form...